Economic Storm Clouds Gather: A Closer Look at the Weakening Job Market

Navigating the Choppy Waters of Uncertainty

Before we get to discussing how terrible the job market is looking, I wanted to give a quick shoutout to the sponsor of our Feature Friday newsletter. Enter Sleeprlo! Founder Kris Nowak says it best:

Sleeprlo sleep products help you get into deep sleep and improve the overall quality of rest you get. Because sleep is too important to leave to a chance.

Don’t miss out on the best sleep of your life and probably the most needed sleep of your life and get in tune with Sleeprlo.

I personally use a Sleeprlo mask!

If you’d like to buy one yourself, feel free to check them out on Amazon.

If you were to ask any financial or economic professional, they would agree with me that it’s essential to keep a close eye on the indicators that shape our financial future. Looking at recent developments, it seems that the U.S. job market is showing signs of weakening and raising concerns about the broader economic outlook.

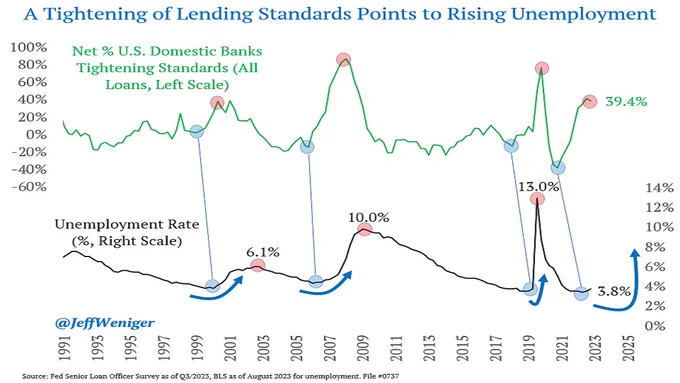

Tightening Lending Standards and Rising Unemployment:

One alarming sign of trouble is the net 39.4% of US banks reporting tightened lending standards. This tightening began in late 2021, indicating a growing caution in the financial sector. Such measures are often associated with economic downturns, and they tend to coincide with rising unemployment rates. As these lending standards constrict, it becomes more challenging for businesses and individuals to secure loans, potentially hindering economic growth.

Treasury Bill Rates Surge:

Another concerning development is the rapid rise in Treasury bill rates, which have soared from 0% to 5.45%. Such a speedy increase in interest rates can have a cascading effect on various sectors of the economy, including housing and job markets. A rise in interest rates often leads to increased borrowing costs for businesses and consumers, potentially dampening economic activity and job creation.

Decline in Willing Job Leavers:

Historically, the end of Federal Reserve tightening cycles has coincided with peaks in the percentage of unemployed individuals who are willing job leavers. These individuals leave their jobs with confidence that they can quickly find new employment. Unfortunately, this trend is deteriorating, signaling a potential lack of confidence in the job market's prospects.

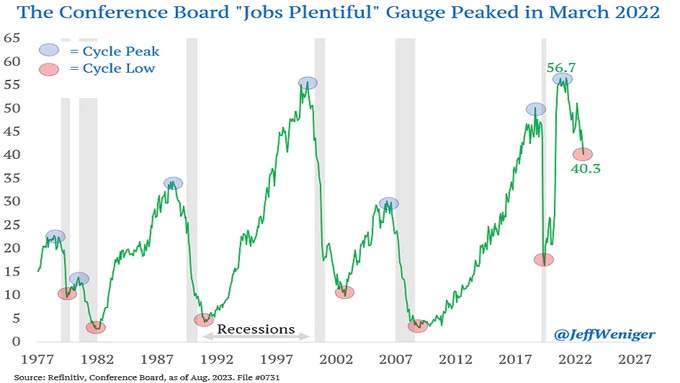

"Jobs Plentiful" Indicator Plummets:

The Conference Board's "Jobs Plentiful" question, a key indicator of labor market sentiment, has seen a dramatic decline from 56.7 to 40.3. Such a bold shift, exceeding the triggers of past recessions, underscores the growing unease among job seekers. It reflects a changing perception of the job market's health and availability of opportunities.

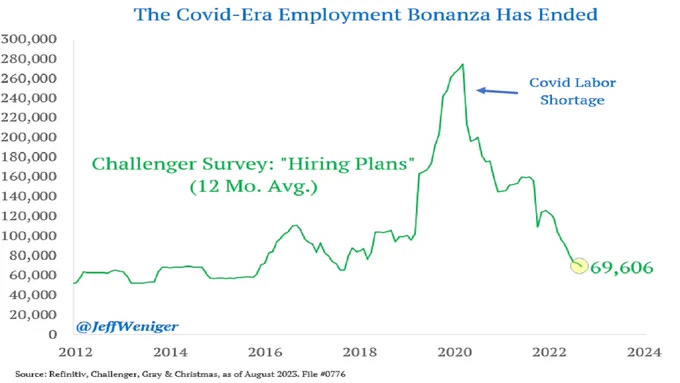

Hoarding of Workers Ends:

During the COVID-19 pandemic, businesses hired more workers as a form of "insurance" due to high employee turnover. This trend has now reversed, as indicated by the Challenger survey. The shift from hoarding workers to cautious hiring practices may be a response to changing market conditions, potentially leading to increased joblessness.

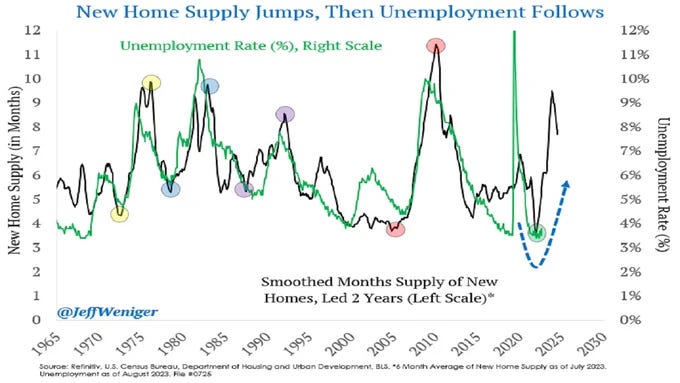

Housing Market Woes:

The housing market, a significant driver of economic activity, is facing challenges on both the demand and supply fronts. A collapse in home demand and supply has disrupted the market's equilibrium, contributing to a spike in the supply of new homes. This "Housing Freeze" is a critical macroeconomic theme that could further exacerbate unemployment.

Decline in New Housing Starts:

New housing starts peaked in the spring of 2022 and have been on a decline since. Such shifts in building activity tend to ripple through the labor market in the months that follow, potentially resulting in job losses within the construction sector.

Services Sector and the Yield Curve:

While some hope that the services sector will buoy the economy amid manufacturing woes, the deep inversion of the yield curve suggests otherwise. A potential contraction in the ISM Services index, dipping below 50, could be indicative of economic contraction, with implications for job stability.

The current economic landscape is rife with warning signs, suggesting that the US job market is poised for a challenging period ahead. Tightened lending standards, rising interest rates, declining labor market confidence, and a struggling housing market all contribute to this ominous outlook. Business leaders, policymakers, and individuals should closely monitor these developments and prepare for potential economic headwinds in the near future. In uncertain times like these, staying informed and adaptable is key to weathering the storm.

Thank you for reading! If you’re a free subscriber, feel free to check out the benefits of the paid subscription. If you enjoy, share, comment, and like. Tell your friends, family, and network too!